The company earns over 90% of its revenues from public sector entities. Its revenues come from two streams embedded solutions and infrastructure services.

Under embedded solutions, ICSA provides controllers for power substations and distribution transformers, and automatic meter readers. It has patented technology to provide remote terminal units for remote monitoring and controlling power substation parameters. Its infrastructure division provides design, supply, and erection of transmission lines and substations.

Under embedded solutions, ICSA provides controllers for power substations and distribution transformers, and automatic meter readers. It has patented technology to provide remote terminal units for remote monitoring and controlling power substation parameters. Its infrastructure division provides design, supply, and erection of transmission lines and substations.Traditionally embedded solutions account for more than half of the total revenue. However, in recent quarters, its share has gone down significantly since there was a delay in launching new power programmes by the government due to elections. Now with the advent of Restructured Accelerated Power Development and Reforms Programme (RAPDRP ), revenue from embedded solutions is expected to grow in next few quarters.

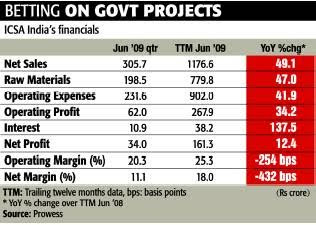

Financials:

ICSA has grown at break-neck speed in last few years. In the two years ended March 09, the companys revenue jumped four fold to Rs 1,111 crore. Net profit trebled during the period to Rs 168 crore. The company has maintained its operating margin between 25-27 % during this period. In recent quarters, while the top line growth has remained robust, its bottomline has been impacted due to rising interest expense. The interest charge is rising since the company has to borrow to meet its working capital requirement due to poor cash generation from operations.

Market Cap 831.64

* EPS (TTM) 34.30

* P/E 5.15

* P/C 4.82

* Book Value 113.61

* Price/Book 1.56

Div(%) 50.00

Div Yield(%) 0.57

Market Lot 1.00

Face Value 2.00

Industry P/E 18.14

Risks:

The company has to fund its operations through external financing since its operations are not generating enough cash. This is on account of very high level of receivables. This can prove to be a major concern for ICSA especially during tough economic situations when external funding comes at a higher cost. On a positive side, it has reduced its number of days for which sales is outstanding (DSO) from more than 180 days a year ago to 163 days. The management has set a target of bringing down the DSO further to 120 days. It expects to turn its operations cash positive by the end of the current fiscal.

Valuations and investment rationale:

At the current price level of around Rs 181, ICSAs stock is traded at a trailing twelve month price earnings (P/E) multiple of 5. Since there is no other listed player of ICSAs size that can match its business operations, it is difficult to build a comparative scenario. Many of the frequently traded small-cap technology companies are traded at a P/E of more than 9. The company has Rs 2,000 crore strong order book to be executed within next two years. Of this, the infrastructure services account for Rs 1,400 crore. With R-APDRP now in place, ICSA is likely to see buoyancy in its embedded solutions revenue. This is a good sign since the division earns better margins compared to the infrastructure business.

In view of its future prospects and the risk attached with it, investors with higher risk appetite can consider ICSA with a horizon of two years.

Source: EconomicTimes