MUMBAI-BASED Seamec owns and operates four multi-support vessels that are used for maintenance of offshore oilfields. French oilfield services and engineering major Technip owns 75% stake in the company, with 13.7% of the equity held by public and the rest held by institutional and corporate investors.

The companys four vessels are currently deployed with Rana Diving from Italy, Indias Dolphin Offshore, Condux SA in Mexico and Dulam International of Dubai.

Seamecs performance in 2007-08 was shaky:

hit by accidents, dry-docking of vessels, rising crew costs and the aftershocks of the global economic crisis on the oil industry. Although partial pressure on charter rates remains, the business scenario has considerably improved in 2009. The companys four vessels have been continuously deployed during the first half of 2009, and the company expects them to be busy till the end of this financial year, boosting its profits. In the last few years, while its peers have been busy leveraging their balance sheets and pursuing rapid growth, Seamec has been highly conservative, preserving cash and staying debt-free .

GROWTH DRIVERS:

Seamec expects to report sizable profits for the quarter ended September 30, 2009, on the back of continuous deployment of its vessels. The company reported a net loss of Rs 12.3 crore in the quarter ended September 30, 2008. It is now scouting for an acquisition for which it has built a war chest over the years. The company has been conserving cash for the purpose it hasnt paid dividend for 12 years now. Seamec last acquired a cable-laying vessel in June 2006.

The company had Rs 63.50 crore in its books for the year ended December 31, 2008, and received Rs 26.40 crore towards insurance claims during the year. When cash flows from operations in the current year are added to these figures, Seamec is expected to end 2009 with a cash balance of about Rs 200 crore. This should be sufficient for the company to purchase another vessel next year without a debt component.

FINANCIALS:

In the last 10 years, Seamecs profits have grown at an attractive compounded annual growth rate (CAGR) of 24.7%, while net sales have risen 10.6%. The company has been debt-free for a few years now. The business of maintaining offshore oilfields also comes with a compulsory holiday every vessels needs to be dry-docked in alternate years which results in additional expenses and loss of revenues. So, a year of higher profits is followed by a year of dip in profits. Since Seamecs balance sheet will record higher profits in 2009, an investor should expect erosion in profits in 2010. If the company buys a new vessel next year, this trend could be arrested.

VALUATIONS:

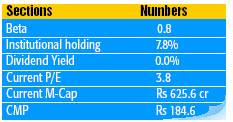

VALUATIONS:Seamecs scrip is trading at just 3.8 times its earnings for a year now less than twice its book value that makes it a substantially cheaper buy compared to offshore support companies such as Dolphin Offshore, Garware Offshore and Aban Offshore. The company is expected to end 2009 with a net profit of Rs 194 crore, at which the estimated price-to-earnings (P/E) multiple works out to 3.2. On the current asset base, the profit for 2010 is forecast at Rs 165 crore, at which the forward P/E stands at 3.8.

RISK FACTORS:

A stronger rupee or weaker charter hire rates of multi-support vessels could have a negative impact on the companys performance. Also, the company is looking at acquiring another vessel, but the execution of a deal and the deployment of the vessel are uncertain events.