I came across one such stock recommended by ET Investor's guide. It is CITY Union Bank .

CITY Union Bank is one of the most efficient banks in the country. With a network of 202 branches, it is present in many parts of the country but its operations are primarily concentrated in southern India. In a recent study by ET Intelligence Group, City Union Bank (CUB) ranked among the top 10 banks in three of the four main parameters. Of the 39 listed Indian banks, CUB stood 7th on efficiency, 10th on growth and 10th in terms of return to shareholders. It is well known that CUB is one of the strongest banks in the country. Our study showed that it is equally good in terms of rewarding its shareholders. The bank has consistently reported net interest margin (NIM) in excess of 3% in the last nine financial years. Only a handful of Indian banks have managed to achieve this feat.

In FY 2009, the bank posted the second highest return on assets (RoA) across listed banks. Only Indian Bank did better. While CUB clocked a RoA of 1.5% in FY 2009, the average RoA of Indian banks was only 1%. This is a key ratio in the banking industry because it explains how efficiently a bank is utilising its assets.

The current fiscal year has been the most challenging for the banking industry since the start of the boom in 2003. For starters, the pick-up in credit slowed down. As per latest Reserve Bank of India data, the growth in aggregate bank credit has slowed to 10.6% year-onyear . Moreover, bankers are still grappling with shrinking spreads, which is an offshoot of tight monetary conditions in the last months of calendar year 2008. Despite such headwinds, CUB managed to grow its loan book at 19% y-o-y at the end of Sept 09 quarter. Though, its net interest income fell down by 4% y-o-y , it still managed to grow its net profit by 21% in the six months ending Sept 09. Net interest income is calculated by deducting interest expense from interest earned and is a measure of spread between cost of deposits and yield on advances. In the absence of growth in net interest income, non-interest income, which grew by 59%, came to the banks rescue.

Meanwhile, the bank has come out with a rights issue in the ratio of one share for every four shares held. The price of one rights share will be Rs 6. The current market price is Rs 25 per share. This shows that there is significant discount embedded in the rights issue. So, it makes lot of sense for investors to subscribe to rights issue. The issue closes on December 16, 2009

VALUATION:

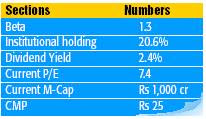

VALUATION:The stock is trading at 1.4 times its book value. Compared historically, the stock is just inches short of its all-time high valuations, as it was trading at 1.6 times its book value in March 2008. However, the banking sector, and CUB in particular, have shown resilience in tough times. Going forward, investors are likely to give more premium to the banking sector in general and efficient banks like CUB in particular. Its peers like Federal Bank, South Indian Bank, Karur Vysya Bank and Indian Bank are trading at an average price to book value multiple of 1.3 times. This shows that City Union Banks stock, at 1.4 times price to book value, is reasonably priced.

Moreover, the bank consistently pays dividend to its shareholders. At the current price, the dividend yield stands at 2.4%, which shows that the stock offers value to conservative investors as well.