Kalpataru Power Transmission (KPT) is a more than 30 years old company founded by Mofatraj P. Munot. The company has four operating business segments: power transmission and distribution, infrastructure, biomass energy and real estate.

Transmission & distribution division (T&D).

This division makes up 75 per cent of company’s revenue and profits and so is the key focus area. Company is an engineering, procurement and construction (EPC) contractor and sets up transmission networks and substations projects on a partnership basis. Power Grid Corp. of India Ltd (PGCIL) plans to float tenders worth around Rs.64,000 crores for nine high-capacity corridors during 12th five year commission. This will surely create huge opportunity for company’s EPC division. The company’s largest international contract from MEW, Kuwait is on good progress track and on time for scheduled completion. It has some repeat international orders in this year.

Infrastructure.

Infrastructure division had earned revenues of Rs.172 crores in FY09. In FY10 this has more than doubled to Rs.361 crores. Infrastructure division contributed almost one fourth of FY10’s profits.

Infrastructure division completed and commissioned the Vijaipur-Dadri Pipeline Project of Gail India and the Chennai-Bangalore Pipeline Project of Indian Oil Corporation in FY10. Company has successfully completed laying down 1,800 kilometers of pipeline. It has captured its first order for setting up a gas distribution network for Gail Gas in the city of Kota. This experience & expertise will enable company to bid and fetch more such orders in similar projects.

Bio-mass energy division.

It is a small division. Two power generation plants situated in Rajasthan generate 7.8 MW each. They generate power from non-conventional energy resources such as agricultural waste. This division earned Rs.50.8 crore in revenue in FY10, which was 6.25 per cent higher than its revenue of Rs.47.6 crore in FY09.

Real estate division. Hardly makes any contribution to the company’s profits.

Future Prospects

The company’s biggest strength is in its project portfolio including BOT road projects. The Indian government’s policy of inviting private sector into the power generation and distribution sector is opening up significant opportunities. The company focuses on maintaining good profit margins in whatever projects it bids for and takes up for development. This makes it one of the players that have a consistently high operating profit margin.

Stock valuation

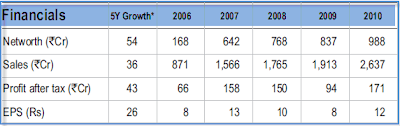

If we look at past 5 year performance of company, sales growth (CAGR) stood at 36%. Compounded annual profit after tax growth is at 43% and EPS growth is at 26%. At current stock price of Rs.120, stock trades at P/E of 10 with EPS of 12 in 2010. This puts PEG (Price to earnings growth) ratio at less than 0.4. Stock of Kalpataru power transmission is available at very attractive valuations. Looking at growth prospects in power sector, you may buy stocks of Kalpataru power in your long term investment portfolio (3-years).